Debt Consolidation For Single Dads: A Great Opportunity To Boost The Credit Score

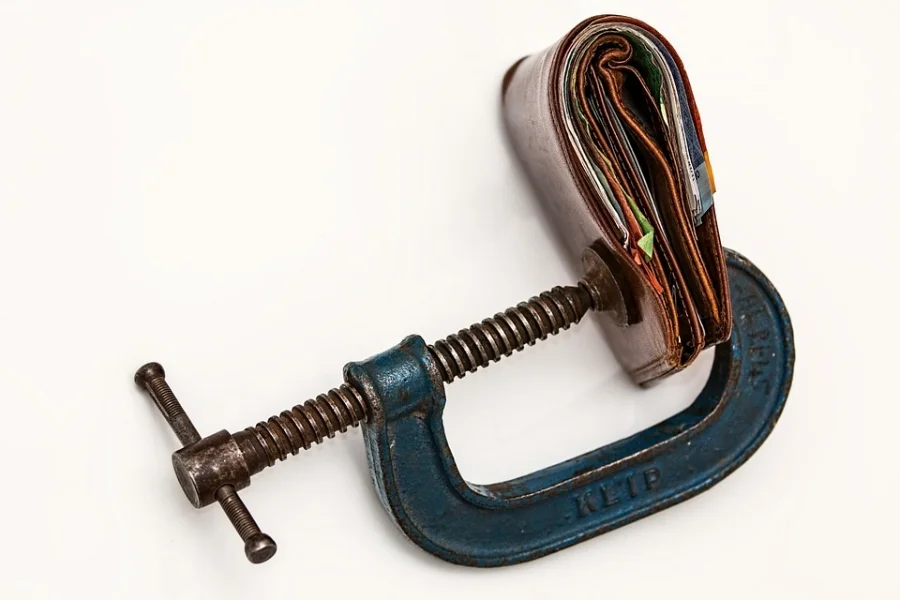

Single dads, who are struggling with outstanding debts in the market, the best solution for them is to work out a debt consolidation loan. If you are looking to get your loans managed effectively, finding a debt consolidation service providing firm is absolutely important. Debt consolidation is a great alternative to other loan repayment options and tends to be a get refinancing medium for single dads. The only thing to ensure is that you do not end up acquiring more debts after consolidating all the smaller loans into one and paying them off with one major loan.

Debt consolidation loans are a great financial tool for single dads who are already facing a lot of problems raising their child. If you are considering consolidating debt, it means that all your multiple debts will be rolled into one loan with smaller payments. That in turn will help to ease the pressure off your shoulders.

You should be careful, because there are many unscrupulous lenders seeking to take advantage of desperate single dads who are in over their heads with their finances. Look to find a reputable consolidation agency after going through several debt consolidation reviews online.

This debt repayment option also enhances your credit score. Here are some of the reasons that support the statement:

Improved Payment History

In case you are struggling with dozens of debt payments at the beginning of every month, you may overlook one or two. This not only leads to a charge on the late fee, but it also results in a downfall in your credit score. When you settle all your debts with a debt consolidation loan, you reduce the number of monthly bills to pay and are left with one loan repayment. Hence, with a single monthly bill to pay, chances are really low to forget it and you can improve your track record in terms of bill payment. A good payment record history is necessary for a decent credit rating.

Customize Your Bill Payment

A debt consolidation loan allows you to manage your budget well for every month. Single dads lead a much occupied lifestyle where they have to meet the specific needs of their child and have to work for paying the bills. Quite often they run out of resources and may have to avoid a bill payment in that month. This can cause a drop up to 50 points in your credit score. This is where a debt consolidation loan can be a game-changing factor for single dads. Thanks to the single fixed amount every month, single dads can prepare their budget accordingly. Apart from that, you can also decide to pay less or more in a month by customizing your loan payment term, as well as, the rate of interest.

Less Credit Card Accounts

With debt consolidation loans, single dads get the chance of closing many credit card accounts. Since it is a known fact that having numerous open accounts can decrease your credit rating, you can have a better score after having them closed. However, make sure that you close all the credit accounts with smaller limits instead of the largest ones.

Conclusion

Finally, with the help of a debt consolidation loan, single dads can keep their credit account balance zero. It makes it appear that you possess a lot of credit in your account and have not used any. A good credit score leads to many financial benefits. Hence, ensure acquiring a debt consolidation loan and keep a decent credit rating after paying all the debts.