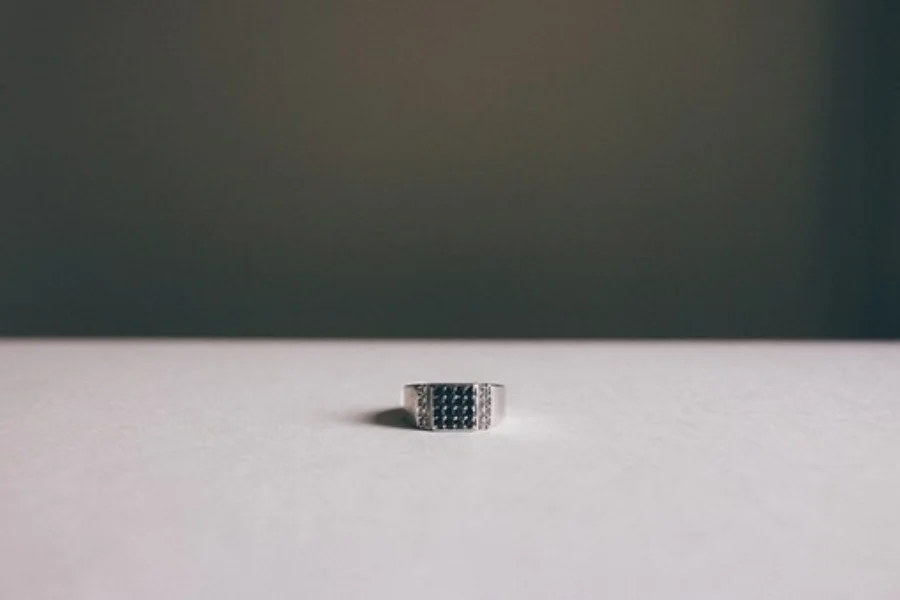

All That You Ever Wanted To Know About Insuring Men’s Wedding Bands

While it is common to spend days, if not months, agonizing over the choice of the men’s wedding ring, most people completely ignore the need for insurance coverage even though it is evident that the typical homeowner’s insurance will be insufficient to protect their investment. Some handy tips for ensuring adequate insurance coverage of your wedding ring:

Estimate Your Current Insurance Coverage

Even though you may have homeowner’s or renter’s insurance, you should know that there is a dollar limit and incidents of damage and loss are typically not covered. You can purchase a rider to your existing policy that will provide cover for high-priced designated jewelry pieces for their full value. If you don’t possess an insurance policy or if the cover is not adequate, you can choose to buy a separate policy to cover your rings. While you can ask your jeweler for a recommendation, you could also ask an insurance consultant or search online for suitable cover.

Know the Terms of the Policy Before You Buy

Never assume that you are getting the coverage you want when you buy an insurance policy. Ensure that you read the fine print to find out if you are covered against all contingencies, from accidental loss to damage or theft. Find out the coverage gaps. Learn how the insurance company will compensate; it could give a cash payout or ask you to buy a replacement from a jeweler of their choice. If the ring is damaged, will they pay for the repairs? How the insurer assesses the ring value is also important; it may just pay you the original purchase price instead of the current appraised value. Find out what documentation is required to lodge a claim and ensure you have them all before buying the cover. You can check out some great ring designs on https://www.mensweddingbands.com/.

Valuation of the Rings

You should always use a professional appraiser to find out the value of your rings so that you purchase the right amount of insurance coverage. Choose a professional gemologist from the directory compiled by the American Gem Society. You could expect to pay in the range of $50-150 per hour; make sure you get an estimate before committing.

Cost of the Policy

The cost of the cover can differ widely between insurance companies so you need to find out the best deal. More than the absolute cost, you should try and establish the best possible cover relative to the cost. Typically, wedding ring insurance costs 1%-2% of the value of the ring per annum; however, if you live in a high-risk area, you will pay more. The premium cost can be reduced by installing home security systems and keeping it in a safe when not using it. The amount of the deductible has an impact on the premium.

Conclusion

Buying insurance cover for your wedding ring is largely a matter of being able to evaluate your risk, assessing the true value of the jewelry, and doing due diligence on the terms of the policy to establish the true cost of the coverage.